As January hits, we at Maersk Growth are reflecting on our 2024 and unwrapping 2025 with insights from the startup ecosystem. So, grab a cup of hot cocoa, settle into your favourite armchair, and let's unwrap the future of supply chain technologies together.

Maersk Growth’s Supply Chain Insights 2024 and 2025 Outlook

While Maersk Growth shifted our direct investment strategy to energy transition innovations in 2023, our commitment to understanding and engaging with the supply chain technology ecosystem remains. We continue to work with our supply chain portfolio companies and facilitate strategic partnerships between startups and the core business in Maersk. This quarterly insight provides an overview of the supply chain tech landscape, drawing from our ongoing interactions with startups, investors, and industry innovators.

The following analysis captures Maersk Growth’s observations in the landscape with the nuanced shifts in funding, technological innovation, and geopolitical dynamics that are reshaping supply chain technologies.

The Funding Rollercoaster of VC Trends in Supply Chain Tech

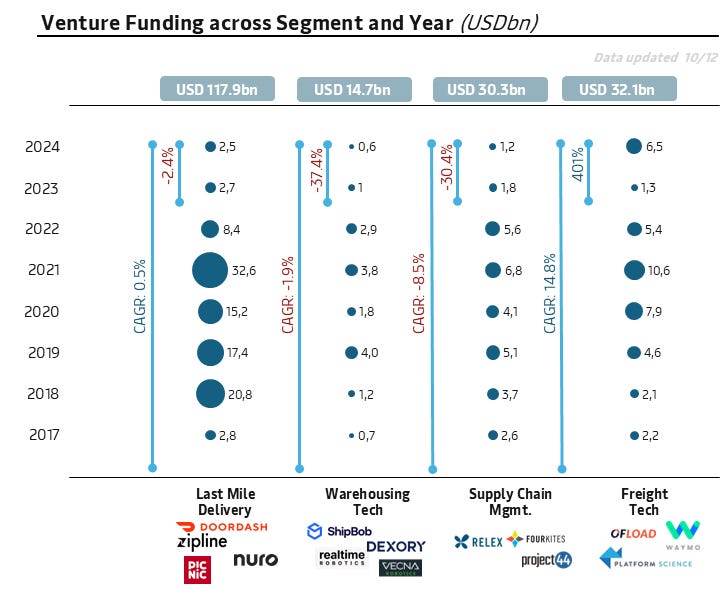

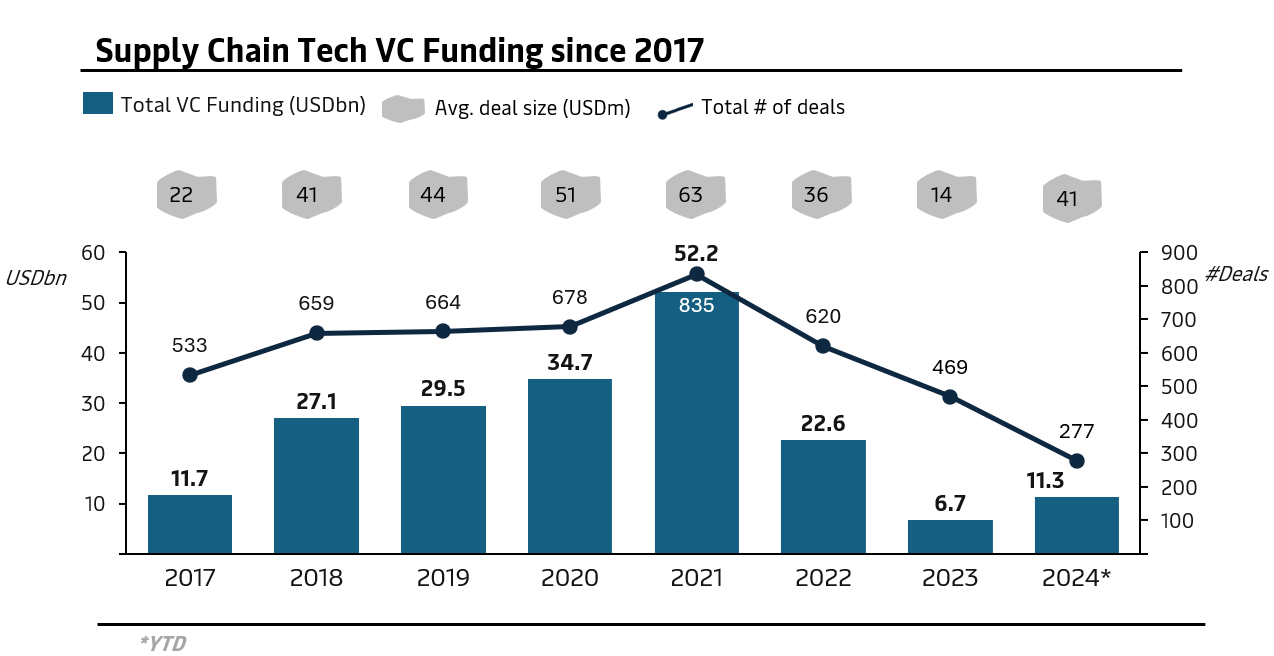

Supply chain tech funding reached an all-time high of $52.2 billion in 2021. This was a significant increase from previous years, driven by the urgent need for digital transformation in the sector due to pandemic-related disruptions. This hype cycle ended abruptly in 2022; funding saw a sharp decline to $22.6 billion in 2022 and further plummeted to $6.7 billion in 2023. This funding slowdown wasn't unique to supply chain tech but reflected broader venture capital market trends across multiple sectors. In 2024, supply chain tech funding rebounded slightly to $11.3 billion (YTD), indicating a slow recovery. While this represents a modest recovery, the figure remains significantly below the 2021 peak.

Despite the challenging environment, certain segments remained attractive. AI-driven technologies, particularly in autonomous vehicles and intelligent supply chain solutions, continued to capture investor attention.

Funding Patterns in Supply Chain Tech Through the Years

The supply chain technology landscape has undergone a dramatic transformation since the pandemic's peak. What was once a sector of explosive growth and massive investments has now entered a phase of strategic consolidation and technological refinement. A couple of observations:

1. Warehouse and supply chain management tech hit a post-pandemic reality check

Warehouse tech and supply chain management funding has declined significantly as the post-pandemic e-commerce boom cooled down. After massive warehouse expansion and automation investments during 2020-2022, many companies are now optimizing existing facilities rather than building new ones.

2. Ultrafast delivery is dead

The ultrafast delivery segment, the expedited shipping method that aims to deliver products to customers in an extremely short timeframe, has experienced a dramatic cooling in funding, exemplified by Getir's recent $250M down round from Mubadala, which led to the restructuring and consolidation of European operations. This marks a stark contrast from the segment's peak when Getir acquired Gorillas for $1.2B just 18 months prior.

3. AI/ML spur innovation in freight tech

While overall funding remains subdued, AI and autonomous driving are attracting significant interest. Waabi's recent $200M Series B, backed by Uber and Khosla Ventures, highlights the appetite for autonomous trucking. Tesla's pivot to robotaxis and Alphabet's $5B commitment to Waymo further support this trend.

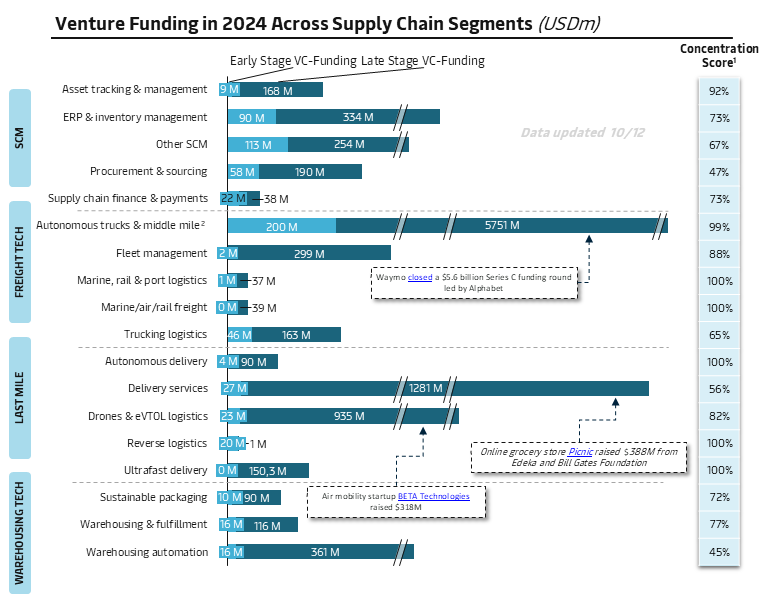

In 2024 Autonomous Vehicles and Air Mobility are Leading The Way

2024 saw targeted investments in cold-chain logistics in trucking and warehousing, and significant funding in autonomous vehicles, and in air mobility infrastructure. While not fully recover to its previous heights, 2024 marked a transition year characterized by more mature, targeted investments in practical solutions rather than speculative ventures. Two strong segments’ have been leading the funding rounds in 2024:

1. Autonomous vehicle dominance

Waymo's latest $5.6B funding round, representing almost 50% of total supply chain tech funding in 2024 (YTD*), demonstrates investors' strong bet on autonomous vehicles as the future of logistics. This concentration of capital, pushing Waymo's valuation to $45B, suggests autonomous vehicles are viewed as the most promising disruptor in the sector, overshadowing alternative solutions like warehouse robotics, logistics software, and last-mile delivery innovations.

2. Air mobility gains momentum

The drone and electric vertical take-off and landing (eVTOL) logistics sector has attracted over $950M in funding in 2024 (YTD*), with notable rounds from Skydio ($400M) and Beta Technologies ($318M). This investment surge indicates maturing technology and growing investor confidence in aerial logistics solutions, suggesting the sector is moving from experimental to commercially viable phases. This also comes in light of the geopolitical situation, where getting aid and other necessary deliveries to war zones and critical infrastructure has become increasingly urgent. The ability of drones and eVTOLs to bypass traditional transportation bottlenecks allows for rapid response in crises, enhancing logistical capabilities in areas that are difficult to access due to conflict or natural disasters.

The supply chain tech sector stands at a critical juncture. The combination of geopolitical tensions, technological advancements, and economic recalibration suggests a future where innovation, resilience, and strategic foresight will be paramount.

Looking Ahead

The supply chain tech sector stands at a critical juncture. The combination of geopolitical tensions, technological advancements, and economic recalibration suggests a future where innovation, resilience, and strategic foresight will be paramount.

What to expect in 2025

3 supply chain tech trends from Maersk Senior Leader

In the rapidly evolving landscape of global logistics, understanding the future requires more than speculation - it demands direct insight from those shaping the industry. As part of Maersk Growth's ongoing mission to explore and anticipate technological disruption, we sat down with Ashish Saxena, Senior Vice President of Ground freight and E-commerce at Maersk, for an exclusive deep dive into the technological trends that will define supply chains in 2025.

As we approach the new year, the global supply chain industry stands at a pivotal crossroad, shaped by technological breakthrough, geopolitical shifts, and evolving consumer demands.

Here are the trends that he observes:

Advancements in AI

Artificial intelligence’s role proved to be a game-changer in 2024. "We now have ample proof points where we have successfully applied generative AI in supply chain decision-making," Ashish explains, referring to notable advancements in forecasting, capacity planning, and pricing optimization. Generative AI is now reshaping logistics, moving supply chains from reactive to predictive systems. Ashish highlights Maersk's commitment to integrating these technologies, enabling real-time prediction and optimization.

Robotics and Automation

"We're not just investing in technology," Ashish emphasizes, "we're investing in resilience." Maersk's approach goes beyond mere technological adoption. The past year underscored the importance of robotics in overcoming industry challenges like labor shortages and disruptions. Maersk invests in automation, testing autonomous trucks and developing robotic solutions to enhance efficiency and resilience. Demand for these innovations is rising globally, marking the start of a transformative journey in logistics.

Multi-Channel Order Management

E-commerce order management is rapidly changing, driven by Asian companies, especially from China, expanding internationally - pointing to platforms like TEMU, TikTok, and Alibaba. Order management technologies have had to adapt rapidly, with trends shifting almost quarterly. Geopolitical risks and tariffs are pushing a shift back to domestic marketplaces. Additionally, Chinese companies like TEMU and SHEIN are now focusing on local marketplaces, challenging established players like Amazon and Walmart. "We're in a period of experimentation," he adds, "learning and adapting in real-time." Ashish notes the need for flexibility and innovation in this environment, with expected shifts in North American markets focusing on faster delivery solutions through tech-driven networks.

The market currently faces a balance of regional challenges and opportunities. Europe struggles with recession while China stabilizes and Southeast Asia grows. If macroeconomic trends continue, as we have seen in 2024, most enterprise customers maintain a consistent approach. "They're laser-focused on visibility, action, and cost efficiency," he says. "They prioritize visibility, cost efficiency, and timely inventory". Ashish emphasizes continuous improvement within existing models to enhance agility and customer focus.

Movers and shakers 2024

The biggest investments in supply chain tech this year

In 2024, several significant funding deals have shaped the landscape of technology and logistics, particularly in the autonomous vehicle and drone sectors. Here are the biggest deals of the year:

🚗 Waymo: Secured $5.6 billion for its autonomous vehicle initiatives, reinforcing its position as a leader in self-driving technology.

🚁Skydio: Raised $400 million, focusing on the development of autonomous drones, which are increasingly being utilized in various sectors including delivery and surveillance.

🛒Picnic: Received $389 million, an online supermarket intended to provide grocery shopping services.

🚑 Zipline: Attracted $350 million for its autonomous drone operations, which are crucial for medical supply deliveries, especially in remote areas.

✈️BETA Technologies: Secured $318 million for its advancements in autonomous drones, contributing to the evolution of aerial logistics.

📊Altana Technologies: Raised $221 million, focusing on data and AI solutions that enhance supply chain visibility and efficiency.

💊PharmEasy: Obtained $217 million, online drug delivery platform designed to improve the supply chain of pharmaceuticals by completely digitizing the process

🍔Rebel Food: Received $210 million for its ghost kitchen model, which leverages technology to optimize food delivery.

🚚Waabi: Secured $200 million for its autonomous trucking solutions, reflecting the shift towards automation in freight transport.

⚡Flink: Raised $150 million for its urban delivery services. Notably the only large investment in ultra fast delivery this year.

2024 wrap up

Before we get used to writing out 2025, let’s take a final look back at 2024 and everything it had in store for us in Maersk Growth. Investments, proof-of-concepts, strategic partnerships, events, startups, investors, colleagues and new connections.

💰Investments

We have done 12 investments in stellar teams and bold ideas over the past 12 months

Our most recent addition to our portfolio is the Swedish sodium-ion battery company Altris and its ambitious team around Christer, Ronnie, Rishi, and Tomas

Despite the challenges faced by the venture landscape in certain sectors throughout 2024, we have remained committed to supporting the most promising and innovative startups in our portfolio, ensuring they continue to thrive and create impact

🤝Collaborations and PoCs

In Q4, we completed 2 PoCs with Responsibly and briink through our venture clienting team

Throughout 2024, we identified 28 strategic partnership opportunities, leveraging both our portfolio companies and external startup collaborations to drive value creation

Maersk Growth was honored for our venture client apporach, receiving an award for our venture clienting approach and earning a spot among the global top-100 corporations driving innovation

An eventful year, and another one to come

2024 offered nothing less than 40 industry events for our team. Of these, we had the honor of speaking at 16 alongside industry-leading investors and startups. Further, we got to gather old and new friends at various side-events around the world.

A key event for us this year was our PortFest – a three-day portfolio festival hosted at our HQ in Copenhagen. When planning the event, we set the bar and our expectations high. As we wrapped up the last day of the PortFest, we realised that those were not only met but were also exceeded in any way possible. This thanks to our brilliant founders, colleagues and network, who joined us with a genuine interest, curiosity, and eagerness to share, learn, spar and grow.

PortFest was many things☝️

💡Bringing bright minds together

🤝Fostering new connections

🍧Serving Innovation Insights & Ice Cream

🍸Mingling at Cocktail Cosmos

📢Participating in meaningful conversations

But mostly, the event was an opportunity for us to gather the founders from our portfolio on our home turf and proudly introduce them to the network we engage with daily, being both our colleagues at the historic A.P. Moller - Maersk HQ and the startup ecosystem gathered at TechBBQ.

Wrapping up the year, we simply can’t make our minds up about our favorite moment, so we’ve gathered a few here. While reviewing these, we are ramping up to kick off 2025. First destination is Las Vegas and Manifest. See you there?

Team

Looking back, we realize how incredibly eventful 2024 has been. Luckily for us, six new colleagues joined us in 2024, adding new insights, connections, and synergies to the Growth team.

To everyone who shaped our 2024, thank you! Here’s to an exciting 2025 which we are eager to kick off! 🎉

Maersk Growth is the global partner for external innovation at A.P. Moller - Maersk, driving the company’s external innovation through venture investments and venture clienting. Our mission is to foster open innovation, create impactful partnerships, and identify strategic gaps within Maersk to co-develop innovative solutions with startups. We focus on monitoring and engaging with supply chain tech and energy transition ecosystems. The insights and views expressed in this content are solely those of Maersk Growth and do not necessarily reflect the official positions or strategies of A.P. Moller - Maersk.

Freight Tech. Is an exciting space. Autonomous trucks and middle mile closely follow the urban robotaxi industry. I wonder which of the two (middle or last mile) are transition friendly. While general public has visibility to last mile, it has less visibility to trucks and ships because the truck hubs and ship terminals are away from cities. The autonomous tech., SCM tech., hydrogen fuel, and wind ships can have the highest impact on profitability in trucks and ships given the volume of trade and freight moved by the them around the world.